Are Closed End Funds Riskier

08, 2021 10:03 am et voya global equity dividend. To make leverage work, a fund must be able to borrow at a lower rate than it earns on the fund assets.

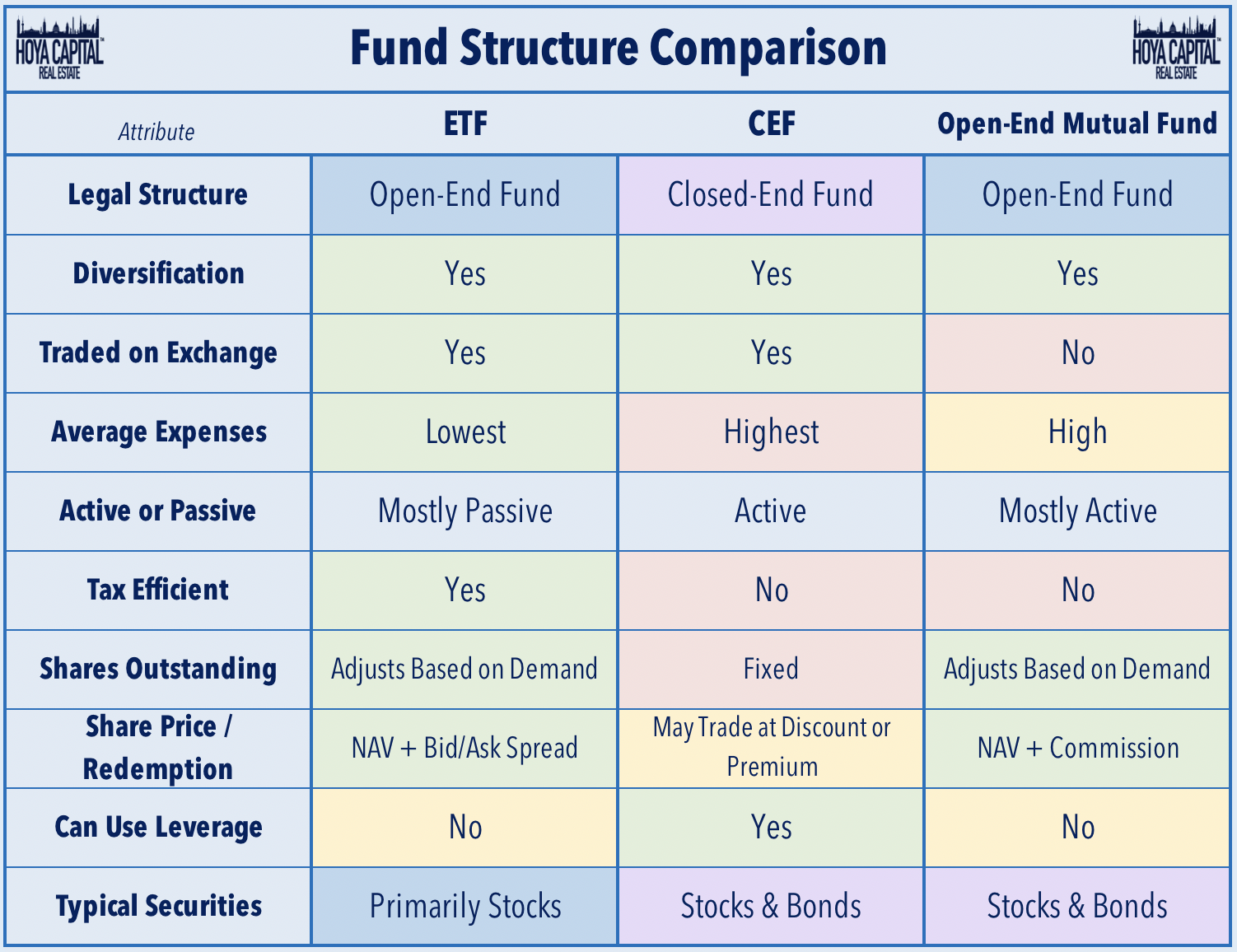

Their security portfolios are substantially different.

Are closed end funds riskier. In the world of taxable cefs, there are similar numbers of stock funds and bond funds. In this way, portfolio managers get a. When the maturity of the fund expires.

High yield and low risk: Rising interest rates will be bad for bond funds. Closed end funds issue a set number of shares at the fund’s origin that trade on the stock exchange throughout the day.

They are a bit more opaque than open ended mutual funds, because the nav's are not always easy to get but generally you can get them on the fund sponsor's website or cefconnect.com which is a good site sponsored by nuveen i think. Clm is a fund to sell, not own. But an asset class that has been around since 1893 offers a compelling combination of low risk and high income.

But it also increases a fund’s volatility and therefore its risk. Igd is a risky bet that its turnaround will last aug. When interest rates fall, the.

The value of these shares is based on demand. If investors dump them, the price goes down. If lots of investors buy shares, the price goes up.

/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

Posting Komentar untuk "Are Closed End Funds Riskier"