Nuveen Closed End Funds Tax Information

For more detailed information on the distributions of a specific fund, please visit the fund sponsor's website. The fund invests in municipal securities that are exempt from federal income taxes.

In order for a distribution to qualify for this tax rate, the fund must hold

Nuveen closed end funds tax information. 2 income may be subject to state and local taxes, as well as the federal alternative minimum tax. For more detailed information on the distributions of a specific fund, please visit the fund sponsor's website. You now have the ability to download your fund's proxy statement and vote your proxy online.

Returns assume reinvestment of distributions, and nav returns are net of fund expenses. For more detailed information on the distributions of a specific fund, please visit the fund sponsor's website. For more detailed information on the distributions of a specific fund, please visit the fund sponsor's website.

2020 tax information letter nuveen municipal mutual funds national funds: Estimates of distribution tax characteristics (19a notices) date document; For more detailed information on the distributions of a specific fund, please visit the fund sponsor's website.

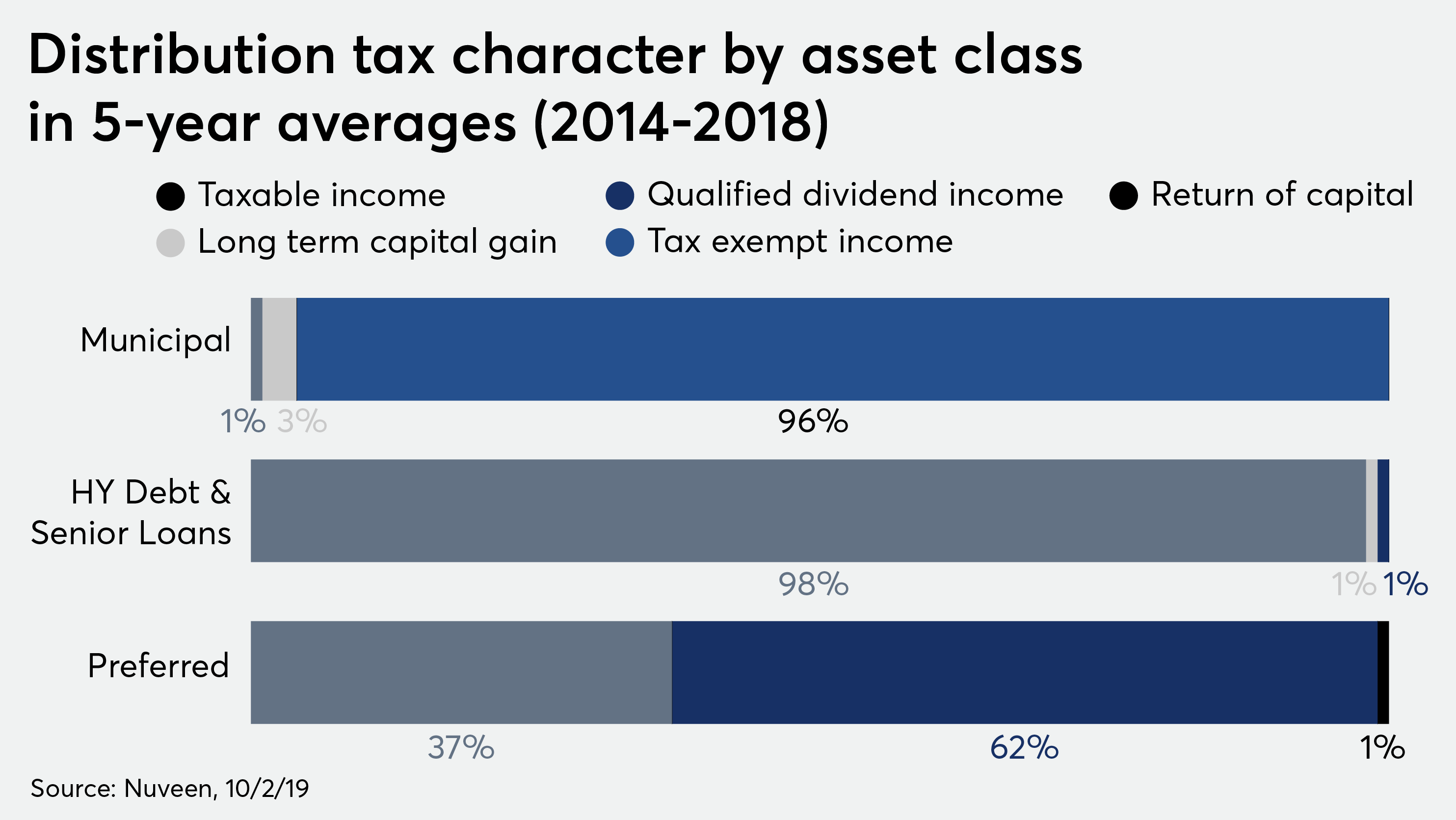

The fund invests at least 80% of its managed assets in municipal securities rated. All shareholders of the funds listed below are cordially invited to attend the meeting of shareholders. Qualified dividend income (qdi) is income generated by the fund and taxed at a maximum amount of 20%.

Additionally, net investment income (which includes all taxable dividends) may be subject to additional 3.8% medicare surcharge. The fund's primary objective is to provide current income exempt from regular federal income tax; The tax treatment of fund distributions may be affected by future changes in tax laws and regulations or their interpretation by the internal revenue service or state tax authorities.

Capital gains, if any, are subject to capital gains tax. Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the federal deposit insurance corporation. The proxy statements below are notices for the most current meeting of shareholders.

Information specific to shareholders of national funds: There is no assurance that a fund’s leveraging strategy will be successful. Secondary objective is to enhance portfolio value and total return.

For those states with a flat tax rate, the state rate is used in the combined tax rate calculation along with the federal rate (28%). For more detailed information on the distributions of a specific fund, please visit the fund sponsor's website.

Posting Komentar untuk "Nuveen Closed End Funds Tax Information"